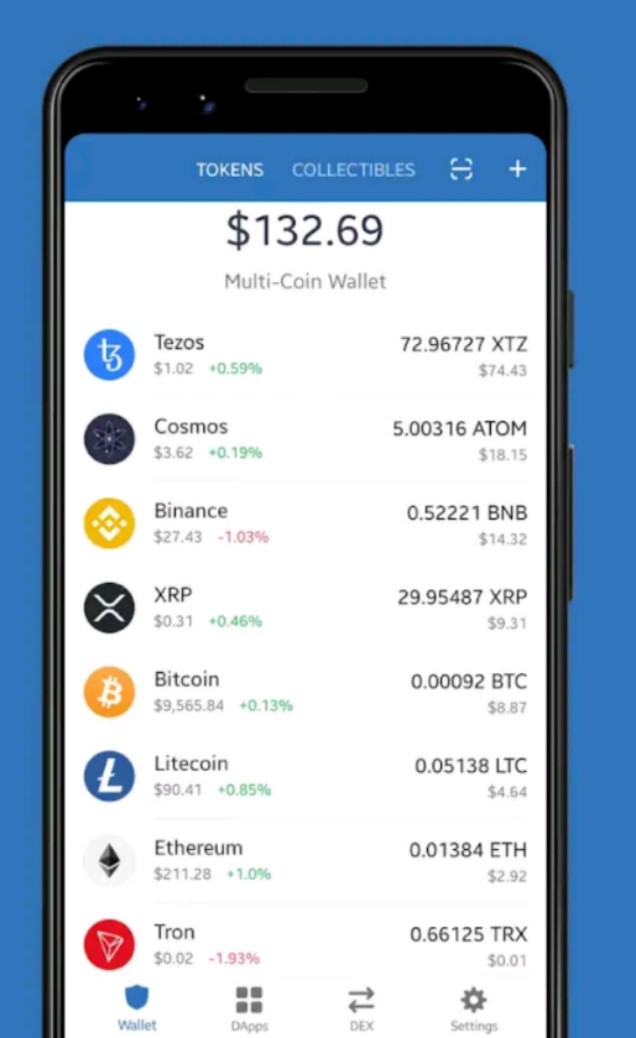

Trust Wallet itself does not charge users any fees for its services. However, users are responsible for network fees when conducting blockchain transactions, which vary by network and congestion levels. Additional fees may apply for swapping tokens or buying crypto through third-party services integrated within the app.

Understanding Trust Wallet Transaction Fees

Nature of Trust Wallet Fees

Trust Wallet itself does not impose additional fees for transactions conducted within the wallet. Instead, users incur network fees directly associated with blockchain operations, such as transfers and smart contract interactions. These fees go to network validators or miners, not Trust Wallet.

Comparison with Other Wallets and Exchanges

Compared to other wallets and exchanges, Trust Wallet aims to provide a cost-effective solution by eliminating extra service charges. While exchanges may charge withdrawal or trading fees, Trust Wallet transactions are subject only to the inherent network fees of the blockchain being used. This approach can result in lower overall costs for users, especially for those actively managing their cryptocurrency across multiple platforms.

How Fees are Calculated in Trust Wallet

Fees within Trust Wallet are calculated based on the blockchain network’s current congestion and demand for transaction processing. For example:

- Ethereum (ETH): Fees are calculated based on gas prices, which fluctuate with network activity.

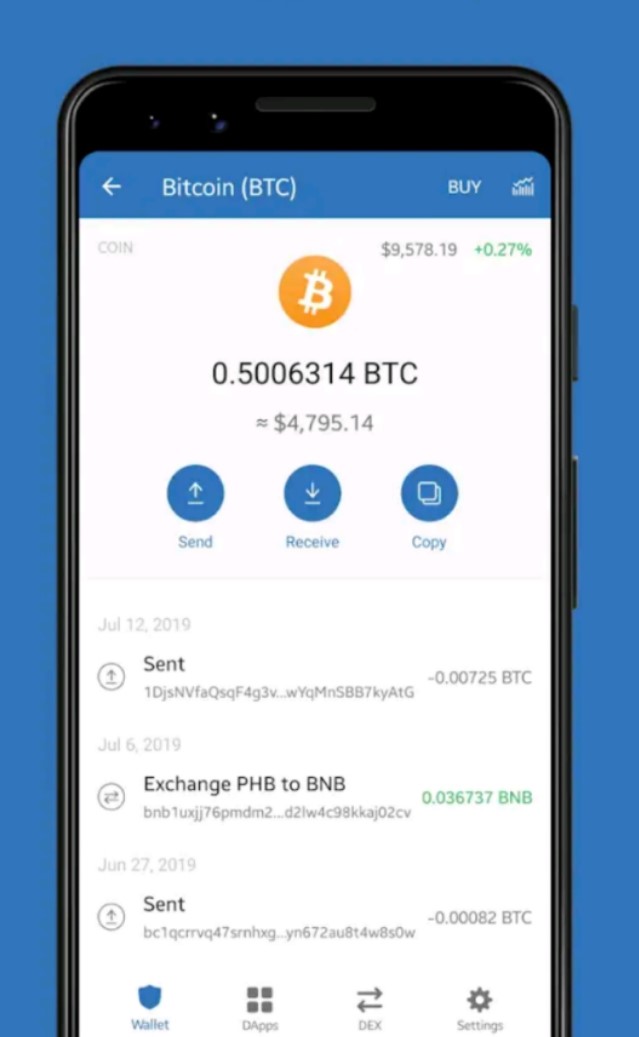

- Bitcoin (BTC): Fees depend on the transaction size in bytes and the network’s current load.

- Binance Smart Chain (BSC): Similar to Ethereum, but generally offers lower transaction costs.

Network Fees for Cryptocurrency Transactions

Explanation of Network Fees in Blockchain Transactions

Network fees, often referred to as transaction fees or gas fees, are essential to the operation of blockchain networks. They serve as an incentive for miners or validators to process and confirm transactions. These fees vary based on the network’s congestion, transaction complexity, and the blockchain’s specific fee structure. Essentially, they represent the cost of utilizing the computational resources required to validate and record transactions on the blockchain.

Typical Network Fees for Popular Cryptocurrencies

- Bitcoin (BTC): Fees can fluctuate significantly based on network activity. During periods of high demand, fees increase as users compete for their transactions to be prioritized by miners.

- Ethereum (ETH): Known for its variable gas fees, which are influenced by the network’s congestion. Transactions requiring smart contract interactions typically cost more.

- Binance Smart Chain (BSC): Generally offers lower transaction fees compared to Ethereum, making it a popular choice for DeFi applications and token transfers.

How to Check Current Network Fees Before Sending

To avoid surprises and manage costs effectively, it’s wise to check network fees before initiating a transaction. Here’s how:

- Use Blockchain Explorers: Websites like Etherscan for Ethereum, Blockchain.com for Bitcoin, and BscScan for Binance Smart Chain provide real-time data on current network fees.

- Trust Wallet’s Built-in Estimator: Trust Wallet automatically calculates and displays the estimated network fee for your transaction based on current conditions.

- Third-party Tools: Several online tools and platforms offer calculators and charts to help users estimate fees based on recent network activity and desired transaction speeds.

Fees for Swapping Cryptocurrencies Within Trust Wallet

How Swap Fees Work in Trust Wallet

In Trust Wallet, swapping cryptocurrencies involves two types of fees: the network fee and the liquidity provider’s fee. The network fee is paid to blockchain validators for processing the transaction, similar to any other transaction on the network. The liquidity provider’s fee is a percentage of the swap amount, paid to the liquidity pools that facilitate the exchange of tokens directly within the app. These fees compensate liquidity providers for the risk of providing liquidity and facilitate the decentralized exchange of assets.

Comparing Swap Fees: Trust Wallet vs. Decentralized Exchanges

- Trust Wallet: When swapping within Trust Wallet, users experience a seamless integration with various decentralized exchanges (DEXs). The app automatically selects the best available rates from connected DEXs, potentially leading to lower fees due to optimized routing.

- Decentralized Exchanges: Directly using a DEX might offer more control over the swap process, including the ability to manually select liquidity pools or set slippage tolerance. However, users must manually compare rates and may incur additional transaction fees when transferring funds in and out of the wallet.

Tips for Minimizing Swap Fees

- Optimal Timing: Network fees can vary significantly based on congestion. Performing swaps during off-peak hours can result in lower network fees.

- Compare Rates: Trust Wallet aggregates rates from multiple DEXs. Take advantage of this feature to ensure you’re getting the best possible rate for your swap.

- Adjust Slippage Tolerance: Higher slippage tolerance can increase the chance of a swap being executed quickly but may result in less favorable rates. Find a balance that works for your needs.

- Consolidate Transactions: If possible, consolidate your swaps into fewer, larger transactions rather than multiple small ones to reduce the overall impact of fixed fees.

Trust Wallet Fees for Buying Cryptocurrency

Fees Associated with Buying Crypto via Trust Wallet Partners

When buying cryptocurrency through Trust Wallet, users are typically redirected to third-party services integrated within the wallet. These partners may include MoonPay, Simplex, and others that facilitate fiat-to-crypto transactions. The fees for using these services can vary and often include:

- Transaction Fees: A percentage of the transaction amount, which compensates the service for processing the purchase.

- Network Fees: Separate from the transaction fee, this covers the cost of recording the transaction on the blockchain.

- Currency Conversion Fees: If purchasing with a currency other than the one the cryptocurrency is priced in, conversion fees may apply.

How to Compare Fees Across Different Payment Methods

Different payment methods, such as bank transfers, credit cards, and e-wallets, can incur varying fees. To compare:

- Review Payment Options: Within Trust Wallet’s purchase interface, review the available payment options and their associated fees.

- Consider Speed vs. Cost: Some methods like bank transfers may be cheaper but slower, while credit cards offer instant purchases at higher fees.

- Check for Additional Bank Fees: Your bank or credit card issuer might charge additional fees for transactions classified as cash advances or for international transactions.

Strategies to Reduce Buying Fees

Minimizing the cost of buying cryptocurrencies through Trust Wallet involves several strategies:

- Choose Low-Fee Payment Methods: Opt for payment methods with lower fees, such as bank transfers, when speed is not a priority.

- Bulk Purchases: Larger transactions can sometimes reduce the relative impact of fixed fees, though you should always consider the risks and avoid purchasing more than you can afford to lose.

- Monitor Promotions: Occasionally, Trust Wallet or its partners may offer promotions or lower fees for certain payment methods or cryptocurrencies. Stay updated with Trust Wallet’s announcements.

- Use Trusted Exchanges: For users seeking the lowest possible fees, comparing rates and fees on various exchanges and then transferring the purchased cryptocurrency to Trust Wallet might be more economical.

By understanding the fees associated with buying cryptocurrencies through Trust Wallet and employing strategic approaches to minimize these costs, users can make more cost-effective investment decisions.